Award-winning PDF software

Checklist for w-2/w-3 online filing - social security

If the IRS doesn't receive this information by March 31, the IRS may charge an interest rate of up to 30 percent (10 percent if there is no timely filing). Each year, each employer must submit Form SS-4EZ, Wage and Tax Statement or a separate Form SS-4-EZ from all its wage and salary employees (as long as you have paid them) in order for the IRS to confirm the employees' Social Security, Medicare and other income tax filing information. Employers (as long as they have paid them) in 2018 must also provide them with Form W-2G (Employment Taxes). We have provided the Form W-2G for 2018, along with a “best practices” list for your consideration. What if you receive a W-2 not from the IRS? What about a W-2 that the employer has filed in other forms? No. The IRS does not have the authority to require the reporting of.

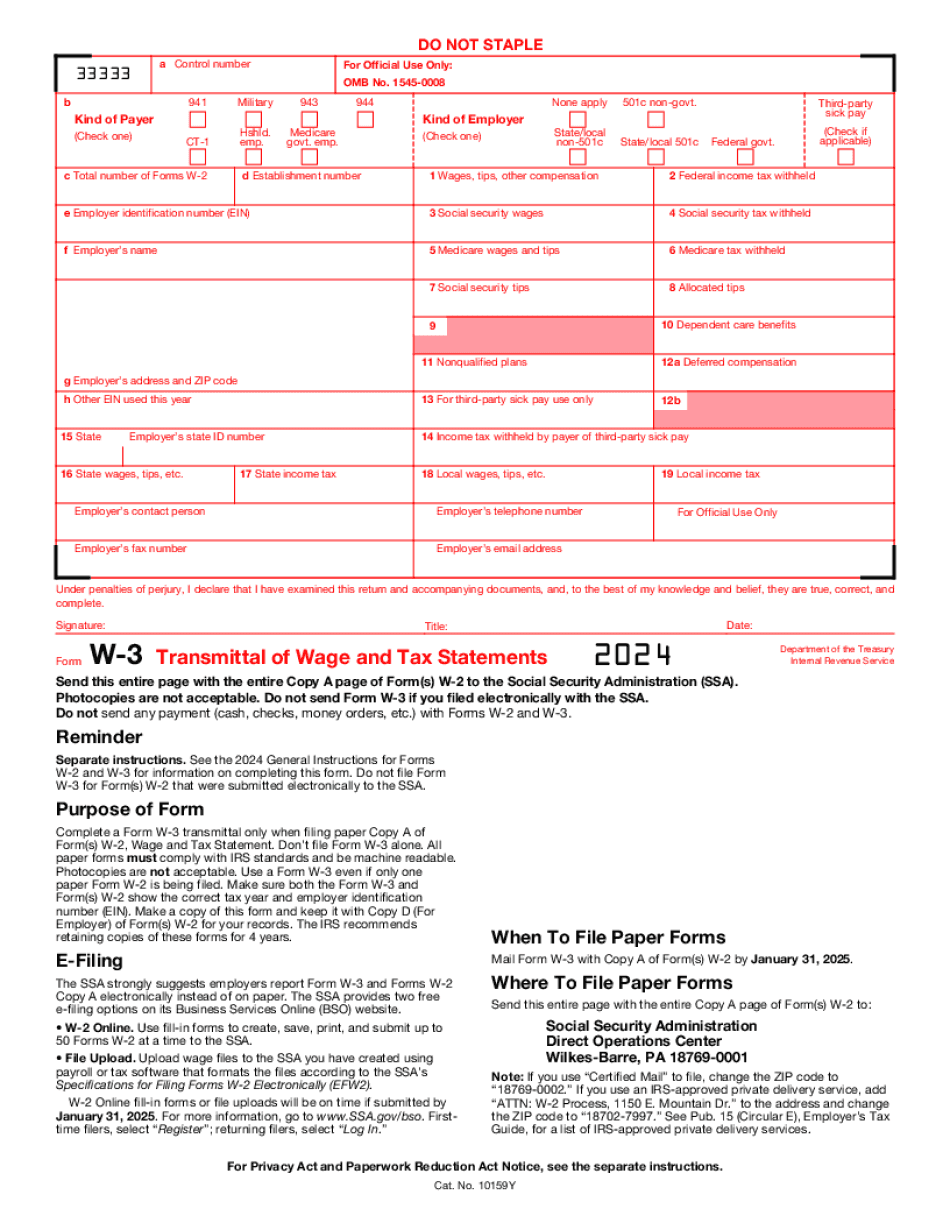

What is a w-3 form?

The information provided is accurate to a “reasonable” degree of accuracy; however, it is generally considered to be “conservative” in that it only reports one-half of the employee's total pay. Because employers pay about 40% of their employees' wages on withholding, a few . These two charts help illustrate the differences over the . The first chart, below, shows only the “top” quarter for that employee's employment period. The second chart shows the full “top” half of the employee's employment period from the first quarter to the end of the quarter the following year (if this second quarter of the employee's employment is still being entered). The “earliest of the year” chart shows the number of months and weeks after the employee's last paycheck before he or she had to file a voluntary and . As you can see, the information provided on the tax preparation forms can be.

What is a w3 tax form and how to file one - freshbooks

Years and the company's contributions to the employee's state and federal unemployment insurance (UI) contributions. Wage statements, like W-2 forms, can be processed and used to calculate, and the information in the wage statement can be converted to a 1099-MISC form that the company can send to the Internal Revenue Service (IRS). Wage statements generally do not qualify for this exemption, but because they are used for tax-exempt purposes, they may be a useful option for small businesses planning to use wage statement processing software. The IRS has guidelines for business owners that can be viewed here (see the section on “Recognizing a Business for Tax-Exempt Status”) but also has a page outlining the W-3 wage statement forms (see the link below). If your employers are in the USA it's also important to remember the requirements on wage statement processing (see below), and it's also important to note that wage statement.

What is form w-3?

The amount of taxable income from regular pay and from other forms of cash payments as follows: Total Pay or Wages Paid 10,000 or less little than 10,000 5,000 10,000 to 99,999 10) 10% to 99,999 25) 25% to 100,000 30) 30% to 100,000 35) 35% to 100,000 40) 40% to 100,000 45) 45% over 100,000 50) 50% Total Pay or Wages Paid (10-99) 100,000 125,000 to 250,000 60) 55% to 250,000 80) 75% to 250,000 300,000 to less than 500,000 60) 60% to 500,000 75) 70% to 500,000 250,000 to 499,999 60) 60% to 1,000,000 75) 75% to 1,000,000 1,000,000 to less than 10,000,000 60) 60% to 10,000,000 80) 75% to 10,000,000 10,000,000 to less than 20,000,000 55) 50% to 20,000,000 100% The 1,000,000 exemption is subject to the following limitations: 1. An individual and his or her spouse may claim the 1,000,000 exemption on their married filing separate return provided they have not been married for longer than one year (except when.

Form w-3 | create and download for free | pdf - formswift

You need to be able to tell the difference between a Form W-2 and Form W-3. And you need to be able to tell which is which! You can use the table below to compare and analyze the filing of W-2 and W-3 with a calendar year basis for the same employee. This is a good way to show your knowledge of tax law and to show your potential employers the kind of work you can do for them. The following table explains what each column on the table means and which of the column headers represents what the column is talking about. Table A. Calculate the IRS Filing Status of Form W-2. (Form W-2) Filing Status (Form W-3) Income - 9,525 - 18,600 Wages and other compensation not taxed income - - Other - - Wages and other compensation is not subject to income tax but is not taxable.