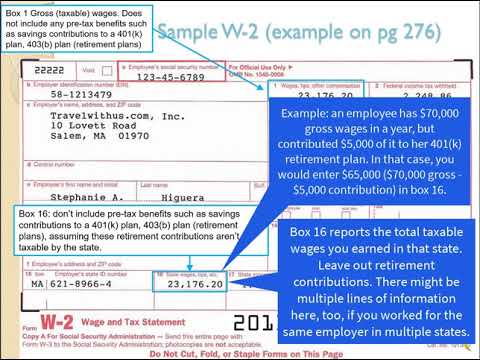

Our next learning objective is preparing forms W-2 and W-3. W-2 is the wage and tax statement on page 276 of your chapter handout. You can find a picture and more information. It's prepared by the payroll department each calendar year. Each employee will get their W-2 after the year ends, and it provides that employee with a summary of their gross earnings and deductions like federal income tax, austie, and Medicare. Copies will be given to the employee, the IRS (Internal Revenue Service), any state where the employee's income taxes have been withheld, and the Social Security Administration, so years later they can figure out how much social security the employee is eligible for. Of course, the company will keep records of it. Here's a sample W-2 again, you can find it on page 276. A) Employee Social Security Number B) Employer's Identification Number (EIN) C) Name of the employer and their address E) Employee's name and address 1) Gross taxable wages - it does not include any pre-tax benefits such as savings contributions to a 401k plan, a 403(b) plan, and other types of retirement plans. So, what you're going to leave out of 1 are gross wages. Notice it's taxable gross wages for federal income tax contribution to your retirement plans such as a 401k or an IRA. Those are not taxable for federal income tax. Let's say you made $70,000 and you contributed $5,000 to your 401k. So, 1 would be your gross wages ($70,000) minus that $5,000 contribution to your 401k. So, 1 would be $65,000. 2) Federal income tax withheld from that employee during the year. The employee needs this information to fill out their tax return at the end of the year. 3) Social security wages - in other words, the wages that...

Award-winning PDF software

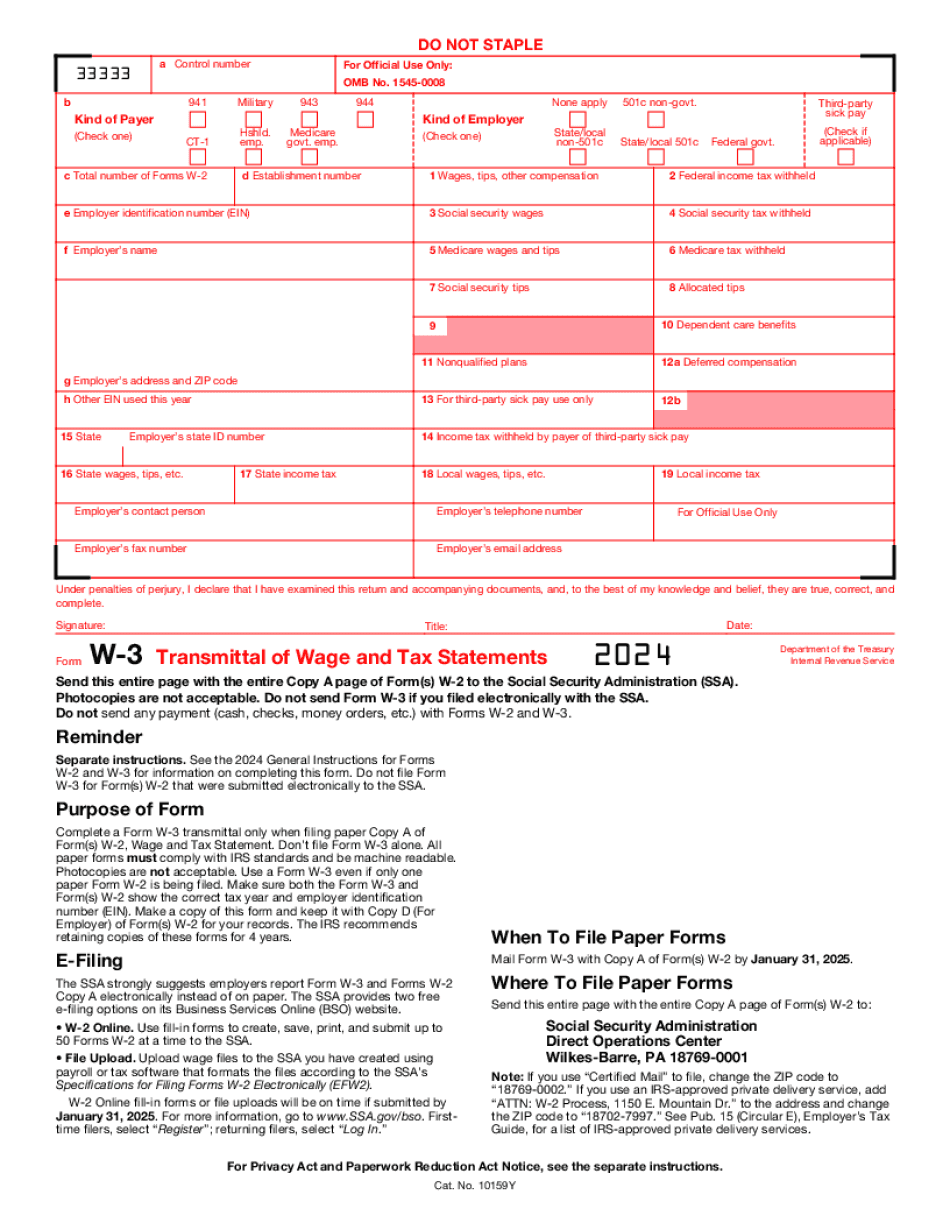

Video instructions and help with filling out and completing Form W-3 vs. Form W3-c