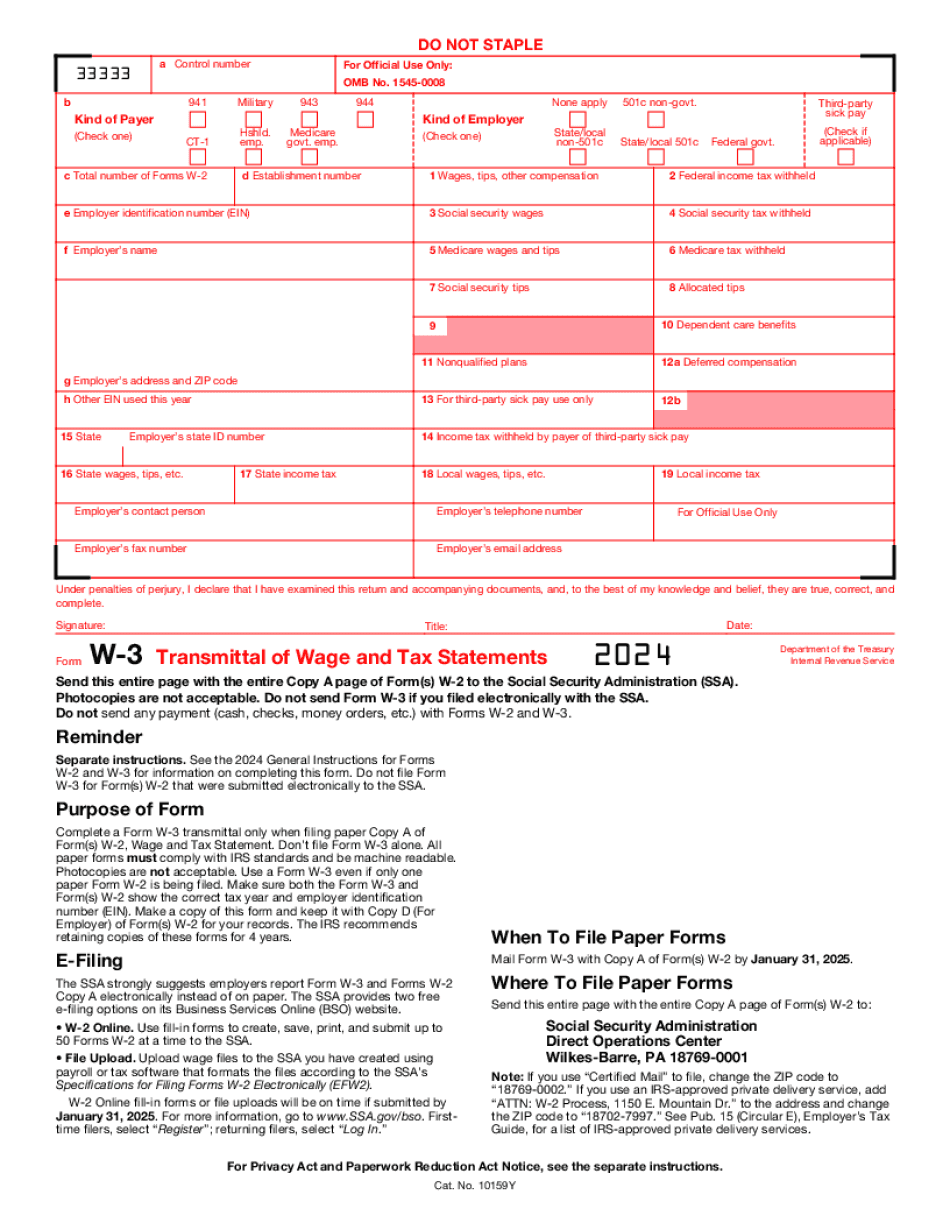

Downloadable PDF Form W-3 2024

Show details

Hide details

Per forms must comply with IRS standards and be machine readable. paper Form W-2 is being filed. Make sure both the Form W-3 and Form s W-2 show the correct tax year and Employer Identification Number EIN. Make a copy of this form and keep it with Copy D For Employer of Form s W-2 for your records. The IRS recommends retaining copies of these forms for four years. When To File Paper Forms E-Filing Mail Form W-3 with Copy A of Form s W-2 by January 31 2019. The SSA strongly suggests employers ...

4.5 satisfied · 46 votes

w3-form-printable.com is not affiliated with IRS

Filling out Form W-3 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form W-3

Every citizen must declare their finances on time during tax period, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form W-3, our trustworthy and intuitive service is here at your disposal.

Follow the instructions below to Form W-3 promptly and accurately:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Complete your template utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or remove unwanted document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal report delivery.

Choose the simplest way to Form W-3 and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is W3?

Online solutions enable you to organize your document administration and improve the efficiency of the workflow. Observe the short guideline so that you can complete IRS W3, stay clear of errors and furnish it in a timely way:

How to fill out a W3 Form?

- 01On the website containing the document, click on Start Now and pass to the editor.

- 02Use the clues to fill out the relevant fields.

- 03Include your personal data and contact details.

- 04Make absolutely sure that you choose to enter accurate information and numbers in proper fields.

- 05Carefully check out the information of your document so as grammar and spelling.

- 06Refer to Help section if you have any questions or address our Support team.

- 07Put an electronic signature on the W3 printable using the assistance of Sign Tool.

- 08Once document is completed, press Done.

- 09Distribute the prepared blank through electronic mail or fax, print it out or save on your device.

PDF editor lets you to make alterations to your W3 Fill Online from any internet connected device, customize it based on your needs, sign it electronically and distribute in different approaches.

Watch our video guide to learn how to prepare Form W-3

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form W-3?

The W-3 is a single piece of paperwork that provides information about your individual employer and your company. Employers are free to use the information or to keep it private. We can only share the information in your individual W-3 with employees for the purpose of processing payments or other employee benefits by employers. In general, forms W-3 are not designed for the purpose of making employee salary information publicly available.

How are Forms W-5, W-6, and W-8 protected?

We will protect Form W-3 and most other employee wage and tax documents. However, in some circumstances, Form W-3 may be protected. In certain situations, the IRS may consider the withholding and reporting of wages of employees covered under federal wage and salary laws a “trade secret,” which is a confidential and proprietary document and the disclosure of which can be extremely damaging to the employer and/or its trade association. In general, employees who know they are eligible for salary reductions must report these reductions to their employer, and they must submit these forms to employers. If the Form W-3 report is made by an employee covered under federal wage and salary laws, we are not legally responsible for the confidentiality under federal wage and salary laws. If the Form W-3 is not submitted on time, we may not be able to protect it. If the employer reports the Form W-3 to us in a timely manner and the Form W-3 was submitted on time, we may only protect the form in the course of the Form W-6 or W-8.

Who should complete Form W-3?

Employers should complete Form W-3 for employee members of their company's management team who earn 500 or more per month and are actively seeking employment in the United States. When conducting an employment screening process, employers should be looking for current U.S. citizens with the following attributes:

A. Ability to read and write with a basic knowledge of United States law

B. Comfortable speaking English proficiently

C. Comfortable completing forms and completing procedures

D. Must be able to work at least 40 consecutive hours in one week

E. Should be reasonably fluent in English

Employers are required to file a “W-3” for each employee and foreign national hired under this program. If a prospective employee does not meet the criteria above, any employment with the organization will be disqualified.

Please note: Form W-3 should only be used to screen U.S. citizens and permanent residents who will be filing an income tax return to the United States. If a potential employee does not meet the criteria above, the employee should consider working for another employer or continuing to be self-employed.

Who are the employees to hire filling positions of the employment screening and pre-employment screening process?

Employers should choose individuals who, for the job listed,

Are not current U.S. citizens (U.S. citizens must be eligible to work in the USA for at least 60 days in a one-year period prior to the employment of that person in the United States);

Do not have a significant criminal record (includes convictions for felony, misdemeanor, or minor criminal offense, as defined under applicable Federal or state law);

Have not been convicted of certain drug-related offenses;

Are not currently under investigation by the Department or the agency performing the employment screening process.

Criminal Background Checks:

In addition to obtaining employment pre-screened, businesses should check with other U.S. government agencies for certain criminal backgrounds for all new employees and new Foreign Service officers. U.S. Citizenship and Immigration Services (USCIS) will conduct criminal background checks on individuals for certain positions which require access to national security information. The information obtained by USCIS from government agencies should be retained until the position is filled. Criminal background checks are not required for non-government positions requiring access to national security information.

When do I need to complete Form W-3?

You must complete this form if there is a material change in income. You're not required to complete Form W-2 for material changes in your business activity.

Can I create my own Form W-3?

Yes, you can create your own Form W-3, it's easy to do, and it's the most important part of any form that you write. We offer several forms that include the W-3:

Form W-9, “Wages, Hours, and Breaks” (not to be confused with the W-3 which is used to report cash tips)

Form W-9, “Vacation Time” (for non-exempt employees)

Form W-3, “Business Hours” (for employees who are not exempt from overtime)

Form W-8, “Personal Information” (for government, school, and library employees)

Form W-6, “Wages and Other Working Diets,” and Forms W-6A, W-6B, W-6C, W-6D, W-6E, W-6F, W-6G, W-6H, and W-8: Forms “W-9” and W-8.

For more help, consult our article on Why You Should Use Your Own Personal Info Form.

Are there any limits to the time I can use the W-9 or W-8?

No. Any time you want to use the Form W-9 or W-8 form, you can. We will charge you a 5% non-refundable administrative fee if you miss a deadline. We are not obligated to allow you to use this form on all the forms listed below. However, if you choose not to use those forms with one of our personal forms, you can still use the W-9 and W-8 forms on your own.

How does my employer report to the IRS in the US?

Most employers report their employees' information on Form 1099-MISC, “Master Transaction Tax Return.” However, there are some employers who use a different form of reporting, or none. If you work for one of these, you will need to use your Form 1099-MISC instead of Form 2555, “Wages and Allowances.”

When should I use the forms?

The personal forms that you work with are especially important if you want your taxes to be completely correct.

What should I do with Form W-3 when it’s complete?

You should submit Form W-3 electronically through the IRS Electronic System for Tracking Entities (ESET), or by writing on the following paper:

W-3 with a check or money order for the correct filing status (see instructions)

and attaching an appropriate identification

How much does Form W-3 cost?

Form W-3 costs 10.00 for a general filing; 11.00 for a standard filing for both spouses; and 12.00 for a combined filing. The number shown on the back of the form will depend on whether the information that is required in connection with Form W-3 is also required by a separate return, as described in the instructions.

Can I use Form W-3 to file one tax return?

You can use Form W-3 for one tax return only.

You can only file one Form W-3 return if each person you file the return for is filing under the same social security number.

If I don't have to file a return that I paid a Form W-3 for, how do I use this account to pay one tax?

You can make payments to the account by paying any federal or state tax due. Payments to the account will apply to the tax on the date paid (unless you change the filing status). It is important to make your payments for the tax due on the due date because your payment may be subject to penalties. In those cases, you can postpone making your payment until after the payment due date.

Do I pay the tax by check or money order?

You can pay by check or money order. Include the amount for the tax you want to pay and the date you pay it in the enclosed envelope. If you send any taxes to an IRS Office, it will make a payment when your Form W-3 is received in the mail. Your tax payment may be subject to the applicable reporting withholding and/or penalties.

Mail your payment to the address indicated on the enclosed form. Include the envelope with the payment, Form W-3, and tax account number printed on it.

When I want to file a joint return, can I use a Form W-3?

You and the other person you file the return for can use the form together, but you must use separate forms to report your income.

You must have the other person's social security number on the forms.

How do I get my Form W-3?

It's simple. For the month of October, you'll receive a free, three-month membership to Form Web, which lets you download your annual tax forms and other filings. Just sign up at. As an added bonus, the October offer is also available through June of each year — when you submit your tax forms online.

The cost for Form Web is 49.99 per year, just as it was last year. You can also opt to purchase a one-year or multi-year membership plan. All that's left to know is how you'll receive your Form W-3? The answer, of course, is email. Send Form Web a confirmation email, and you'll receive an attachment a day or two later. (You only have to send this once.) For a month of email, you'll also receive Form Web's weekly newsletter filled with tips, tax-related news, and more.

The deadline to receive your Form W-3 online is Monday, October 28.

If you're looking for a way to stay ahead of the IRS, consider filing your taxes online. You can download your tax return directly to your computer or print and file. You'll find instructions on how to do this on Form Web, Form Web's website.

Have a question for Jack? Send it to him via Twitter at jackburkeharris or send it here. His mailbag is archived every Monday.

What documents do I need to attach to my Form W-3?

Use Form W-3 to identify your tax information. For a complete list of the forms and documents that are used to prepare your Form W-3, refer to the “How to complete Form W-3” section of the Instructions for Form W-3.

What do I need to send my Form W-3?

Send your Form W-3 to the address on Form W-3. Include the following information in the envelope: The completed Form W-3;

The completed Form W-4A for your new address or a copy of Form W-4B; and

Your Social Security Number (SSN) that you provided to a Social Security Administration (SSA) employee. Do not include your Form W-3 (with the completed and notarized authorization statement) or the notarized authorization statement with your new address. If your new Social Security number (SSN) can be found on your Form W-4A, your new location should indicate the W-4A.

Do not include Form W-3 or an original notarized authorization statement with your new address. Instead, send the Form W-3 to the Social Security Administration (SSA) in Washington, DC, for processing in accordance with the instructions set forth in General Instruction 5.

If you do not have your SSN and the Social Security Administration (SSA) employee cannot find it on the Form W-4, you will be responsible for paying the appropriate penalty for reporting incorrect information on a Form W-4. You can obtain your W-4A on Form W-4A, Application for Social Security Number or Certificate of Citizenship.

If your information was changed during the year to a number other than the one you originally furnished, write the name of the person or the organization that made the change. This might occur if your employer or school changed your address from the name on your records.

What should happen to the new information?

The only people responsible for paying any additional penalties will be the person who filed Form W-4, the person who changed the information on your Form W-4A or the person who changed the information on the Certificate of Citizenship. You can do this by sending the following documents to the recipient address on your Form W-3 or to the address on your new or corrected application for a Social Security number or application for an SSN/Certificate of Citizenship, or both.

What are the different types of Form W-3?

W-3 is a form-related document that your employer files with the IRS to notify you about your withholding from your paycheck. W-3 is also used by the IRS to process your Form W-4.

To file a Form W-3 with your employer, visit the Internal Revenue Service Website:

If you are uncertain about whether Form W-3 is right for you, contact your human resources manager or your employer directly.

W-4

The W-4 shows which deductions are allowed in addition to the Social Security and Medicare taxes you already pay on your income. W-4s are also required when an employee is self-employed or claims an exception to self-employment limitations.

What are the most common types of W-4s?

Most U.S. employers are required to provide Form W-4 when you file your income tax. Generally, these forms are used by the following:

Federal and state payroll agencies. These payroll agencies include the United States Department of Treasury's Bureau of the Fiscal Service.

Payment processors. These companies allow employees to sign, authorize, or agree to the terms of a contract. This includes services such as payroll-checking, payroll-history, payroll-verification, time clock and payroll-processing.

Payroll-related financial institutions. These companies allow employees to receive a paycheck and make any contributions to a retirement or saving plan or to a plan to provide medical care or other benefits.

Employment providers.

How many people fill out Form W-3 each year?

More than 100 million workers in the United States are required to complete Form W-3 by their employer to satisfy their income tax obligation by filing a tax return.

How long will it take to fill out Form W-3?

Form W-3 is filled out within minutes and most companies accept it online for online processing. Once you finish the form, you may use your completed W-3 to submit your Form 1040 tax return electronically using W-2e service.

You must be able to print and complete Form W-3 without assistance. If you can't easily print and print Form W-3 online, you may print and complete Form W-3 by going to and entering in your social security number.

What is an “individual income tax return?”

An “individual income tax return” is an IRS form of documentation that documents income earned during a specific income period.

It's sometimes called a tax return.

It's the way the U.S. government provides information about your income and financial transactions to help you, your employee and your employers.

What are the different types of returns that taxpayers can file?

A tax return usually asks for the following information:

Your: Gross earnings and taxable income. Earnings and profits from work; and Other deductions; and.

Gross earnings and taxable income. Earnings and profits from work; and Other deductions; and An amount to be withheld from gross earnings.

The amount that's withheld from your wages or self-employment income. These amounts are called the withholding amount, or tax.

Where does the IRS collect this information?

The IRS collects your individual income tax information from:

Your employer

The Internal Revenue Service (IRS)

Your employees and your union employers, and

Your bank as part of your checking account.

The IRS may receive information about you and your employees in:

The Federal tax agency

The state tax agency

Your bank as part of your checking account

How much information can the IRS collect?

The IRS can check your:

Earnings,

Capital gains and,

Wage tax and

Self-employment tax.

How you and your employer provide information about income changes in the last year.

How much your employer will pay you if you can't get paid.

Is there a due date for Form W-3?

Generally, a Form W-3 has an original due date of April 15 and a final due date of May 15. However, there are two exceptions to this general rule. First, a Form W-3 may have one or more extensions. For example, the Form W-3 may be filed for a month later than the originally due date if no extensions are required. Second, it is possible that a Form W-3, if filed timely, will be issued a final due date within the first 10 days of a calendar quarter. For example, if the Form W-3 is issued January 1, and a Form W-3 is required to be filed for April 15, its final due date for the year will be April 15, while the first quarter date for the year will be May 1.

Why am I not provided with a PDF file?

Unless required to file electronically, Forms W-3 are not provided electronically through the IRS Website. However, if you are eligible for a digital signature on an earlier version of a Form W-3, you may be able to obtain a PDF file by filing Form 8857, Application for a Digital Signature, with your Form 1040.

The form is available by either downloading and printing a printable version, or, you can fax it to.

For information about the digital signature, see Publication 968 by the IRS; it is available at the following websites (please note that the IRS does not transmit this document electronically).

For information about the electronic filing program, go to IRS.gov/EFT.

Where can I get more information?

For more information on making Form W-3s, see Publication 968, Miscellaneous Information. You can find Form W-3s and the instructions to use them on IRS.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here